Market Overview:

The UK property market in 2024 has shown a period of stabilization following the initial exuberance seen at the beginning of the year. Key trends include:

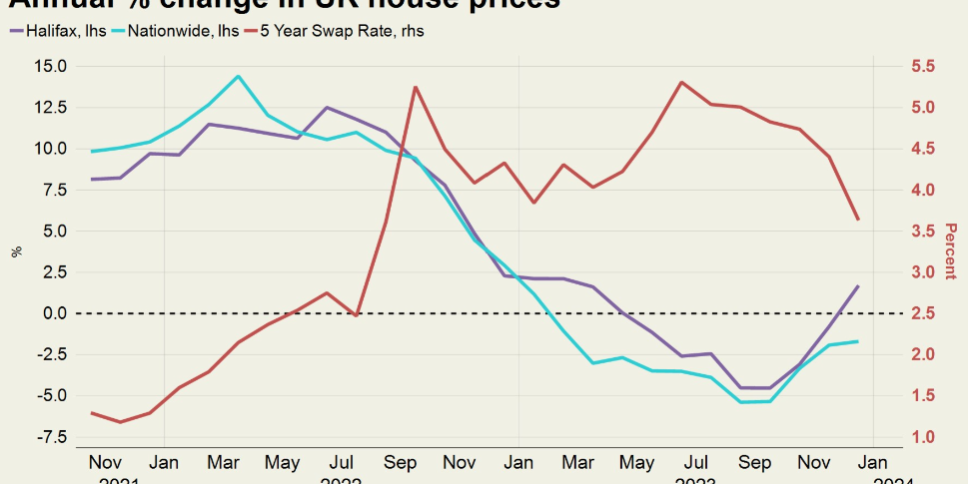

- Modest Growth: After a slight dip in April, house prices have seen a modest annual growth of around 0.6%, according to Nationwide Building Society. This suggests a shift towards a more sustainable market pace after a period of rapid price increases.

- Regional Variations: Growth is not uniform across the UK. Regions like the North East and North West have seen the strongest growth, while some areas in the South, particularly London, have experienced price stagnation or slight declines.

- Market Activity: While not at pre-pandemic levels, market activity has remained consistent. The number of completed transactions has ticked upwards, indicating continued buyer interest.

- Mortgage Rates: Mortgage rates have stabilized after a period of increase in 2023. This, coupled with rising wages, is expected to improve affordability for some buyers.

- Economic Outlook: Inflation remains a concern, but there are signs it may be peaking. The Bank of England has kept interest rates stable for the past six meetings, suggesting a cautious approach to further rate hikes.

Investment Synopsis:

The UK property market continues to present both potential rewards and risks for investors. Here’s a breakdown of key considerations:

Pros:

- Long-Term Potential: Despite the current slowdown, the UK property market has historically shown long-term capital appreciation, offering the potential for significant returns over time.

- Rental Market: The UK rental market remains robust, with strong demand in many areas. Buy-to-let strategies can provide consistent rental income for investors.

- Geographical Diversification: The UK market offers diversification within a single country, allowing investors to target specific regions based on their growth potential and investment goals.

Cons:

- Market Fluctuations: The property market is susceptible to economic cycles. Short-term dips in rental yields or property values are a possibility.

- Interest Rates: Rising interest rates can increase borrowing costs, impacting affordability and overall returns.

- Taxation: Property investors in the UK face various taxes, including Stamp Duty Land Tax (SDLT) on purchase and potential Capital Gains Tax (CGT) on sale. Understanding these tax implications is crucial.

Investment Strategies:

- Location Selection: Careful location selection is vital. Research areas with strong rental demand, economic growth prospects, and potential for future capital appreciation.

- Investment Type: Consider your goals and risk tolerance. Buy-to-let offers rental income but requires active management. Off-plan properties can offer attractive entry points but come with construction risks.

- Professional Advice: Consulting with a property expert from Edifice Invest can provide valuable insights and guidance throughout the investment process.

Conclusion:

The UK property market in 2024 presents a more measured investment environment. While potential rewards remain, careful consideration of risk factors and a well-defined strategy are crucial for success. For long-term investors seeking diversification and steady returns, the UK property market can be a viable option, provided they conduct thorough research and seek professional guidance.

To speak to one of our advisors please fill out your contact information!